Udemy – C Corporation Income Tax Form 1120 BOOKWARE-iLEARN

English | Tutorial | Size: 3.07 GB

Learn to enter tax data for a C Corporation into tax Form 1020 from a CPA

This course currently consists of a comprehensive problem showing the data input process of a C Corporation into tax Form 1120.

This course will put together a systematic format of entering data into a Form 1120 that will minimize errors, isolate problems as they happen, and remove the possibility of having to start the process all over again.

We will enter each M-1 adjustment individually into both the tax return and an Excel worksheet so that we fully understand how M-1 adjustments function.

We will start by reviewing the data for the comprehensive problem.

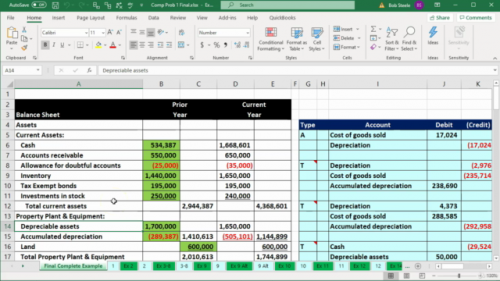

Then we will enter the data into an Excel worksheet that will be used to help us organize the information.

We will be using Lacerte Tax software to enter the tax data into Form 1120. However, we will also provide PDF files of the tax forms so learners can enter the data directly into the tax forms as we go. The tax forms can also be found on the IRS website.

The course will demonstrate how to enter the data into the tax forms in stages to reduce potential mistakes and to identify mistakes as they happen so they can be fixed as easily as possible.

We will start the data input with the balance sheet.

Then we will enter the income statement as it is formatted in the adjusted trial balance.

Next, we will systematically go through the M-1 adjustments. We will isolate these adjustments, reviewing them on the tax forms, in the software, and using our Excel worksheet.

We will then review the tax forms.

Who this course is for:

Tax professionals

Business owners considering a Partnership form of business entity

Tax and accounting students

RAPIDGATOR

https://rapidgator.net/file/25f53b65153722a36edbd9217a844a09/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part1.rar.html

https://rapidgator.net/file/5f63a0f474654bdc9762a1530c717c59/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part2.rar.html

https://rapidgator.net/file/f40fb610d16d4d5974cbd26381a029ac/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part3.rar.html

https://rapidgator.net/file/7668308501e8e4008c051bfd8b64023a/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part4.rar.html

https://rapidgator.net/file/352d3487ee38ae4765c37ddefeac836b/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part5.rar.html

NITROFLARE

https://nitro.download/view/346BBCAC12BCEDC/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part1.rar

https://nitro.download/view/0995AEB304C5D64/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part2.rar

https://nitro.download/view/79CCC3ABE3B7EE2/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part3.rar

https://nitro.download/view/83AE0ACED84D30D/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part4.rar

https://nitro.download/view/D305365A7F471F9/UDEMY.C.Corporation.Income.Tax.Form.1120.BOOKWARE-iLEARN.part5.rar

Leave a Reply